- Oil Peak

- Posted

Cutting oil dependecy

Economic analysts are starting to warn of the threat rising oil prices pose to Ireland’s recovery prospects. Richard Douthwaite argues that energy efficiency and renewables investments must be central to government plans, and explains how more than 100% of the cost of energy investments may come back to the exchequer.The penny is finally beginning to drop in financial circles. Increasing numbers of investors are coming to realise that the age of abundant oil is over for ever and, that as shortages develop and prices rise, they can expect a great return from holding shares in companies developing replacement energy sources. One sign of this came at the end of February when Jim Barry, the chief executive of renewable energy and waste management group NTR, which has assets valued at €1.38 billion, announced that he was stepping down to become chief investment officer of a new renewable energy projects investment company. NTR is setting up the new firm in partnership with BlackRock, the world’s largest fund manager which has $3.6 trillion of assets under management. Ten or twelve other NTR people are moving to the new company which will have its headquarters in Dublin and employ between 20 and 25 people at the start.

Jim Barry, chief executive of NTR, has announced that he is stepping down from his position to become CEO of a new renewable energy projects investment company, which NTR are setting up in partnership with BlackRock, the worlds largest fund manager

Our politicians, however, have yet to catch on. They have still to recognise that, if Ireland does not cut the amount of imported energy it uses, buying the energy it needs will absorb a higher and higher proportion of our incomes year after year.

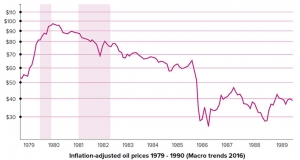

This higher energy spending means that Ireland can say goodbye to any hope that it can grow its way out of its debt crisis. Because domestic demand is almost certain to fall thanks to government spending cuts, our only hope of increasing our incomes is to earn more from overseas. That will be hard if the global economy is depressed but if the global economy grows, its demand for energy, and in particular for oil, its favourite fuel, is going to grow too. As a result, the price of oil will increase because, now that the peak in conventional oil production has been passed, it is no longer possible to raise the world's oil output to keep pace with increased demand. The extra amount we have to pay for our oil will snatch away the extra income we were hoping our export growth would earn. Indeed, our import bill may rise by more than the increase in our export earnings and the economy could shrink rather than grow.

Ireland imported oil worth €4 billion in 2010 - that's €1,000 for every one of us at a time when oil averaged about $85 a barrel. At the current price of $125 a barrel, consumers are going to have to pay nearly 50% more than they did last year. The extra €1.9 billion we will have to find acts as a tax. It takes away money that the government could have taken in tax itself and used to balance its budget. Or, put another way, Ireland would need to get a 2.9 % reduction in the rate of interest it is to pay for the ECB/IMF bailout money to have the same effect. The extra money spent on oil nullifies the effect of a 1.5% rise in GNP.

It was calculations on these lines that led Ernst and Young's version of the European Central Bank's New Area Wide economic model to predict during February that if oil prices were to stay around $120/ barrel this year and next, the eurozone economy as a whole would only grow by around 1%. The Irish economy would not manage even that. With an oil price of €85 a barrel, the model predicts that Irish GDP will shrink by 2.3% this year before growing slightly (0.9%) in 2012. But, if the $120 price applies, the model says GDP will slump by a further 0.5% in both years. And at $150/barrel, GDP could fall by 0.6% in 2012.

The price of Brent crude, which was averaging around $85 a barrel until last November, has since risen by nearly 50% to around $125. This will cost Ireland an additional €1.9 billion a year

Other people have done similar sums. Fatih Birol, the International Energy Agency's chief economist believes that oil prices began to threaten the global economy's recovery when they passed $90 a barrel. He said in an interview in February that if the price averaged $100 a barrel this year, the US would have to spend nearly $80 billion more on oil imports than it did last year while the European Union would have to spend $76 billion more. The increase in US import costs would present a "serious problem for business and consumer confidence, which the US economy desperately needs for sentiment to improve," he said. The European Union was also at risk, he added, because "Europe is the weakest link in the chain of the global economic recovery."

James Hamilton, a professor of economics at the University of California, San Diego, has worked out that a $20-a-barrel increase in the price of crude oil pushes up US petrol prices by 50 cents a gallon. This costs consumers about $70 billion a year and knocks about 0.5% off the US growth rate.

Higher oil prices increase the cost of almost everything, with energy-intensive products like metals or services like transport being particularly affected. Food costs rise too, not just because a lot of oil is required to run the industrialised food-growing, processing and distribution system, but also because increased amounts of foods such as maize are grown to be burned. There would be 14% more maize on the world market if the US was not turning so much into alcohol to use as a motor fuel.

Between 1920 and the 1980s, the price of electricity fell by 90% in terms of the number of minutes it took the average worker to earn enough to buy a kWh. In Sweden, for example, it fell from 400 seconds work to around 35 seconds sixty years later. Food prices fell by almost as much. In the US, for example, a 3lb chicken which took 160 minutes work to earn in 1919 cost only 16 minutes work in the early 1980s.

The fall in the price of energy, food and many basic household goods left people with more money to spend on other less essential things and gave birth to the consumer economy. Of particular relevance to Construct Ireland readers is that it enabled people to spend more of their income on their houses, buying bigger and more comfortable ones.

Although the cost of energy and food continued to fall in countries where incomes grew quickly – Ireland being one – prices in working time terms have been stable in most of the richer countries since the 1980s, in part because most of the extra income produced by economic growth was captured by the better-off. In the US, for example, more than 80% of the increase in national income generated by economic growth between 1980 and 2005 went to the richest 1% of the population which now enjoys almost 24% of the nation's income, up from only 9% in 1976.

The fact is that the amount of time the average person takes to earn his or her daily energy and food requirements has started to rise again after a sixty-year fall and thirty years on a plateau. The new trend will leave everyone with less money to pay for the luxuries to which they have become accustomed, such as running a car. It also makes it harder to scrape together the money to pay the mortgage or the rent, reducing property values.

Ireland's terms of trade are changing as a result of the higher energy and food costs but not all sectors will be affected equally. On the one hand, the agricultural sector will do well as food prices go up in time terms and it becomes more profitable to grow energy crops such as miscanthus (elephant grass) and short-rotation coppiced willow. Overall, the relative prices of food exports and Ireland's energy imports might stay much the same. On the other hand, the price of the manufactured goods and the services that Ireland exports will almost certainly fall in relation to the cost of energy. We will have to supply more of them, perhaps much more, to maintain our energy imports because we are going to be competing for a shrinking fuel supply with every manufacturing and service economy in the world. Only the very smartest economies have a chance of bucking this trend.

So, while it made economic sense until recently to export goods and provide services overseas to earn the money to import fuel, from now on it will be the other way around. The most prosperous countries will be those which don't have to devote a large part of their national effort to making goods to swap for their imported energy because their energy will come from their own resources and, even though its price may be high, the money they pay for it will at least go to their own people who will pay taxes on it and use it to employ others.

The new government's top priority should therefore be to phase out energy imports as quickly as possible. This phasing out will require the use of imported energy, of course, but the quantity of goods and services we will need to give up to buy the energy required is smaller now than it will ever be again. Consequently, so long as the energy is used well, the projects which result from its use should bring a better financial return than they would do if the energy had to be imported to carry them out later on.

“Ah,” you might say, “that's all very well but the country is broke and the banks aren't lending. How are these phasing-out projects going to be financed?” To which I'd reply “Because of the uncertainty, people in Ireland are saving huge amounts. A lot of those savings have gone overseas because the savers don't trust the Irish banks. The money will come back once they are sure that they have somewhere safe to put it. At present, there's nowhere. Can you think of a single renewable energy project in which ordinary people can invest?”

The FAO Food Price Index shows global prices for meat, dairy, cereals, oils and sugar. In January 2011, the index hit an all time high of 231

The government's task is not to spend money it hasn't got on carrying out projects itself but to create the circumstances in which other people are happy to find the funds and carry them out privately. This is the programme the new government should follow:

Step one: stop clinging to the idea that there will be a return to business as usual.

The government should initiate a major debate on the country's energy future, making it clear that it believes that the real price of energy is going to rise and rise and that Ireland will be impoverished if it has to buy that energy from overseas. It should stress that it's not just a question of price either, because now that the world has run out of surplus production capacity, there is an increasing risk that the supply of imported oil will be disrupted, causing difficulties in the transport system. The state campaign should attempt to get everyone to think through what rising energy prices, unreliable supplies and falling real wages would mean for them personally. Its aim should be to get the public to spend on saving energy at home and in their workplaces and to invest in renewable energy production.

Step two: provide ways for people to invest in an Irish energy supply.

Ireland's energy independence should be financed by setting up a state agency to sell energy bonds, each of which would entitle the owner to the value of a specific amount of energy at some specified date in the future when the facilities the bond sales had financed had come on stream. The agency would make a market in the bonds so that holders could sell them if they wished before maturity. These bonds could also be used to finance improvements to the energy infrastructure, such as the grid.

It is very important that communities develop their own energy supplies as, without them, increasing amounts of their income will be required to buy fuel and, unless they can earn that income back, they will be impoverished. Consequently, communities would invite the agency's community energy division (CE) to study their potential renewable energy sources and produce a report on how they might be developed and the cost of doing so. If the community decided to go ahead, it would set up a company and CE would act as a consultant to that company. Suppose, for example, the locality had wind, biomass, hydro and animal slurry. CE would work out a way of developing these in combination with each other so that the highest value local energy needs (lighting, vehicle fuel, cooking gas?) were met first and, as far as was possible, whenever there was an electricity flow out of the community, it happened at times of peak demand elsewhere. Equally, if the wind was not blowing and the community had to take in power, the amount taken at peak times would be minimised by putting the biomass-fired CHP plant on full load and running the hydro plant. Smart meters would also help by cutting out low priority electricity uses temporarily.

An energy bond might be for 10,000 kWh for delivery in December 2015. When it matured, the holder would get whatever the inhabitants of the community were paying for 10,000 kWh at that time. No interest would be paid on the bonds. Instead, those with longer maturity dates would be sold at a lower price than those with shorter ones.

Each district would issue bonds to finance its projects but CE would provide a guarantee for them. Its relationship with the community company would therefore have to give it sufficient authority over the management of the projects to ensure that enough power was being produced to generate the income to pay off the bondholders as their bonds matured. CE might, for example, have a management contract. It would charge a fee for its guarantees and for making a market in the bonds. The bonds could be sold anywhere in the world – it would not be necessary for locals to buy them. Equally, it would not be necessary for all the projects which the bonds financed to be in a community's own area. Some communities would have the potential to carry out big projects and other communities could share in these.

CE would make the arrangements for the electrical component of the community energy company's output to be fed into the grid. Anyone in the local area who wished to do so could nominate the community company as their electricity supplier and the bill they got from ESB Networks, which would still read their meters, would be in two parts. One part would be the actual marginal cost to the community company of producing and delivering the units they used. This cost would include the maintenance costs of the wind turbine and the cost of the woodchip for the CHP plant. It would also include the payments for the agency's services, the cost per unit of using the grid and the charge for top-up and spill, which the design of the system and the smart meters would minimise.

If a kWh cost 15 cents, the actual costs of production and delivery might amount to 5 cents. VAT would be paid on this part of the bill. The rest of the bill would be to cover the cost of buying out the bondholders as their bonds matured. This would be a loan repayment and no VAT would be payable on it. Bills for heat or biogas direct from the community company would also be in the two parts.

Two-part bills make the system tax efficient but there is more to them than that. The non-VAT-able part of the bills would be a form of saving for the customer. Each payment a customer made would build up his or her investment in the community company. Once they reached a certain age, however, the savings element would stop and they would only pay the marginal cost for their power. They would also get their capital investment back month by month as a form of pension, paid for by younger customers taking over their stake in the community company.

This savings element would make the system very attractive and the price of electricity from other suppliers would have to be considerably lower than that from the community company for them to be able to compete.

The agency would also stand ready to issue bonds on behalf of the promoters of major projects and to make a market in the bonds it had issued. These bonds would not carry its guarantee, however. Investors would have to rely on the management of the companies concerned who could always take out performance insurance in the way that film production companies purchase completion bonds to give comfort to their investors.

Arrangements which would leave foreign investors in permanent control of Irish renewable energy sources should be rejected because accepting them would mean that, once the initial investments have been paid off, the lion's share of the income from the sale of the energy would leave the country. The only income staying here would be the wages of a few workers. Spirit of Ireland – the project to store electricity from the wind by pumping water into high-level dams – is apparently looking for funding overseas. It must avoid falling into this trap.

Step three: give priority to energy for transport and for heating

Only the biggest fossil energy users have their greenhouse gas emissions controlled by the EU's Emissions Trading System (ETS). Emissions from Irish agriculture such as the belching cows, from road transport and from oil, gas and coal used for heating, are all excluded from the ETS and yet the country has to reduce them by at least 20% by 2020. If that target is not met, the government will have to buy permits from other governments to cover the shortfall and their price could be very high.

It is going to be tough to meet the target because, short of slaughtering a lot of cattle, nothing can be done about the agricultural emissions. As a result, heating and transport emissions need to be cut by much more than 20%. Electric cars will help, of course, but these are made abroad and will do nothing for employment here. Cutting the amount of heating our buildings require by organising massive retrofitting programmes and by burning biofuels such as willow and miscanthus to supply the residual heat requirement is a much better strategy. Biofuels can also be converted into synthetic diesel fuel using pyrolysis.

Grants are already being given and will almost certainly continue to be needed to get people reducing their energy use and switching their fuel sources quickly. However, a simple calculation is enough to show that, if the grant scheme is planned properly, the government can quickly get its money back.

At present, about 50,000 houses a year are getting an energy-upgrade at an estimated cost of €150 million. 5,000 people are said to be employed. The benefits to the state are as follows:

1. VAT at 13.5% on €150 million 20m

2. PRSI and income tax on the installers' wages - say €5,000 each 25m

3. Saving because 5,000 people are not on the dole, €17,500 each 87.5m

(social welfare, rent allowances, medical cards etc)

4. VAT on the installers' personal purchases 5m

5. Tax and PRSI on the jobs created by the installers' spending (1 job for every 5 installers) 5m

6. Social welfare saving on indirect jobs 17.5m

7. Saving on reduction in need to buy emissions permits at €25 per tonne of CO2. Note that this saving is made every year so we can capitalise the savings over ten years. Say 2 tonnes per house. €50/house x 50,000 houses for ten years 25m

Total 185m

In addition, we need to allow for the money that would have left the country to import fuel. That will now be spent in ways which will provide more employment in Ireland and thus improve the state's finances. The total also omits the benefits that come from living in warmer houses and also having fewer people unemployed. Both groups are healthier and many studies show that the state consequently makes a considerable saving on their healthcare. But even without these additions, we can conclude that the state stands to recoup more than the cost of the energy-upgrading work and if it gave a 50% grant it would more than double its money. The figures above are only ball-park estimates, of course, and ideally a model of the Irish economy would be used to improve them.

It’s also important to qualify the above figures by recognising that the current spend – €150m on upgrading 50,000 houses a year at an average spend of €3,000 – is only scratching at the surface as these must be very light upgrades. Let’s suppose Ireland engages in deeper retrofits of circa €20-€50,000 per house, where people are incentivised to implement a wider range of measures such as wall and attic insulation, airtightness, glazing, heating controls, renewable energy systems, ventilation systems, and non-energy measures such as installing dual flush toilets, low flow fittings, rainwater harvesting systems, and so on. The government is missing a trick if it designs a retrofit programme solely around the concerns of maximum energy and carbon savings per euro of state subsidy. Incentives might most obviously be added for people to include water savings investments – some of which will increase energy savings, such as the installation of low flow taps, aerated showers and body-form baths.

Even if the government were to integrate water saving upgrades, yet their focus remained on cuts - in energy, emissions and water usage – they may be taking the wrong approach. If the government focuses on cuts, it will tend to think about the cheapest way to make the biggest savings, rather than the best value in terms of achieving the greatest possible employment gains and improving the physical and mental health and productivity of Irish people.

Many external insulation contractors say that the main demographic they're succeeding with is middle-aged couples with the mortgage mostly paid off, who are becoming more comfort-conscious. It may also make sense to include grants to make homes adaptable. It stands to reason that if people are upgrading their homes to make them warmer and cheaper to heat, they may also be willing to spend money to adapt the house so that they can continue to live there as they become less mobile. They may also wish to adapt or extend the house to enable their children – who may be unwilling or unable to afford to buy their own homes – and their young families to live there too, leading to healthcare savings on aging parents and childcare savings on the grandchildren.

More comprehensive upgrades would mean a great deal more people being employed, not only because of the greater average spend, but because installing multiple measures probably means using lots of different specialist sub-contractors/installers. People may be willing to spend more - for instance to choose a more expensive window or solar panel because they think it'll be more durable, or because they prefer how it looks – and that's a good thing for the economy, and should therefore be encouraged.

Step four: get ahead of the posse

Just because exporting manufactured goods will become more difficult does not mean that we should give up on it altogether. Denmark became a world leader in producing wind turbines because its manufacturers were able to gain experience and build production volumes thanks to the support they got from the state in their home market. Germany has done the same with solar, Austria with wood-pellet burners. Ireland needs to find its special niches. One could be in wave or tidal technology, another in turning biomass into vehicle fuels. Others could involve retrofitting techniques. But Irish companies will only find and develop these niches if the government decides that it is not going to follow the international crowd but move further and faster than everyone else.

A report commissioned by Siemens pointed out last year that the impacts of an oil and gas price rise are more severe on Ireland than other economies particularly because of the knock-on effects in global markets and trade. So, since Ireland is rated the seventh most oil-dependent economy in the world there is every reason to act in a more determined way than other countries. A slow, half-hearted phasing out of imported fuels should be totally rejected as a national option. The speed with which these fuels are eliminated will determine the programme's success.