- Oil Peak

- Posted

The Twin Crises

Feasta Economist Richard Douthwaite on Greenhouse Emissions and the Oil Peak.

Why does the Irish Government never seem to anticipate when big changes are going to be necessary and start preparing for them in good time? And, even when it accepts that changes must come, why does it always drag its feet? Two severe crises are about to break over us because of this behaviour.

The Emissions Crisis:

Ireland is going to have to pay heavy penalties to the EU for its failure to keep its CO2 emissions in check. In 1998, so that the EU-15 as a whole could honour its commitment under the Kyoto Protocol to reduce its total greenhouse emissions by 8%, Ireland agreed to ensure that, between 2008 and 2012, its emissions would not be more than 13% above their 1990 level. Immediately after signing this agreement, the government allowed the construction of two cement plants which, by one estimate, used up all the permitted increase in emissions by themselves. As a result, as early as May 1999, the European Commission was forecasting that Ireland would miss the emissions target by between 14 and 34%. Figures issued last year by the European Environment Agency put the country right in the middle of that range.

The main tool that the government was considering using to approach its emissions target was a carbon tax but it was announced in September (2004) that plans for this had been abandoned. As a result, the only way that Ireland can hit the target now is for the economy to collapse so that air and road transport is reduced and almost all construction work stops.

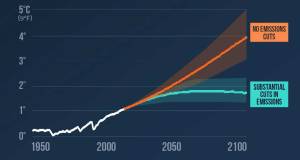

If things continue as they are, we will be able to cover some of the emissions over-run by buying emissions permits from Britain , Sweden , Luxembourg and Germany which, as the chart shows, have some to spare because they have cut back more than they promised. However, these permits are likely to be expensive given that other EU countries are having problems meeting their commitments too. Moreover, European Commission restrictions mean that permits can only be bought to cover emissions up to 10 per cent above the target. After that, the country will be fined €40 per tonne for every tonne of carbon dioxide in excess of the limit between 2005 and 2008, and €100 a tonne from then until 2012.

A €100 per tonne fine would increase the cost of a kilowatt-hour of electricity from Ireland 's two new peat stations by 14.3 cents, from Moneypoint, a coal-burning station by 9.2 cents, and by 4.6 cents from a typical gas-fired station. But would energy users pay these fines through their electricity and fossil fuel bills, or would the cost, which the economist Peter Bacon estimates could increase to $1,300 million a year, be carried by the taxpayer, thus subsidising energy consumption and preventing the market telling people to find ways of using less power? Dermot Ahern, who carried energy in his ministerial portfolio until recently, looked totally bewildered when I asked him last year how the cost of paying the fines would be handled.

The Second Crisis:

Ireland had six years warning of the emissions crisis and did nothing. It has had thirty years to get ready for the second, much more serious one and has done nothing about that too. The second crisis is that world oil production has peaked, or is about to do so in the next few months, and after the peak it will never reach current levels again.

The significance of this is that the present size of the world economy is only possible because of high levels of fossil energy use, and if the supply of that energy begins to contract, particularly the main form of energy used by the transport system, then the global economy will contract too. We are, in short, at a turning point in human history. Moreover, global gas supplies will peak in a few years too. The total amount of energy available to humanity from both gas and oil will begin to fall within the next 10-12 years.

The oil peak is the reason why all energy prices are so high at present, although the media blames a set of little local difficulties such as hurricanes in the Gulf and unrest in Nigeria and Iraq rather than the fundamental cause.

Humanity has used up roughly half of all the easily-extractable oil on the planet, mostly in the past 50 years. The clearest evidence for this is that the giant oil companies are failing to find enough new oil fields to keep up with demand. Indeed, their exploration results are so bad that, despite the high prices, it doesn't even pay them to look for oil any longer. According to report issued this autumn by Wood Mackenzie, a firm of energy consultants, the commercial value of oil and gas discovered over the past three years by the 10 largest listed energy groups is running well below the amount they have spent on exploration.

Warnings that the oil peak would be reached about now have been around since 1970 when Esso forecast it for around the year 2000, a date delayed by a few years thanks to the slower growth in demand following the oil shocks of 1973-1979. Other warnings came from the UK's Department of Energy in 1976, the Global 2000 Report to the President (1980), the World Bank, Global Energy Prospects (1981), and from numerous independent studies such as that by M. King Hubbert in 1977.

Although international competition for the dwindling supplies will ensure that high oil prices will be a permanent feature of life from now on, Ireland – in common with every other country – did nothing to prepare itself. Instead, it turned itself into the 7th most oil-dependent economy in the world, and the third most dependent in the EU after Portugal and Greece . Oil makes up 60% of primary energy consumption in Ireland , compared to an EU average of just 43%. Indeed, Ireland is even more dependent on oil for its energy than the United States : the latter is ranked 30th in the world in terms of oil-dependency, with oil providing 40% of it total energy requirements.

It wasn't always this way. Up until the mid-1990s, Irish oil consumption per capita was below the EU average. However, we've put a Celtic Tiger in our tank during the economic boom, with the result that Irish oil consumption per capita doubled between 1989 and 2001, whilst that of the EU and the world as a whole remained unchanged.

It is worth noting that EU oil consumption is now lower than it was during the 1973 oil crisis, whilst ours is considerably higher. In other words, despite the warnings, successive governments have allowed our energy economy to head off in entirely the wrong direction over the past thirty years.

Our current standard of living requires that we import some 9 million tonnes of oil every year, an amount which is still growing. In view of the government's plans for the continued expansion of the road network and the second runway at Dublin Airport, it obviously believes that, emissions restrictions and the oil peak not withstanding, the import tonnage will climb much higher still. There's little evidence of joined-up thinking here.

It need not have been this way. On a per capita basis, Ireland has the best renewable energy resources of any EU state. ESB International figures show that, theoretically, wind energy alone could provide 15 times more electricity than we are currently using. On top of that, we have excellent biomass, wave and tidal resources. Surprisingly, even our solar prospects are good. Yet we have done the least of any EU state to develop our renewable energy potential. At the end of 2002, only Finland had less wind energy capacity installed – it has put its efforts into biomass energy instead – and in 2002 alone, Spain, with very much poorer wind conditions than Ireland, installed 1,493MW of wind capacity, eleven times the total amount that Ireland had installed by then and over a hundred times more than we installed that year. There is some hope that this will change as the Irish government is due to announce new renewable energy policies based on a consultation process it carried out earlier this year. Even if the change does come soon, the years of delay will still cost the country billions of euro in terms of the penalties to be paid to the EU and the higher prices for energy imports that earlier action could have avoided.

How high are oil and other fossil energy prices likely to go? The US Federal Reserve Chairman, Alan Greenspan, has recently been pedalling the line that the current high oil prices will do little damage to the world economy because oil makes up a smaller proportion of the value of world output than it did in the 1970s at the time of the OPEC price shocks. He may be right, but another way of looking at this is that there still is a fair bit of room for prices to rise before they cause the world economy to collapse and the demand for energy to plummet, along with Ireland 's greenhouse emissions.

In the longer term, I think that fossil fuels will rise to price levels which mean that we will all have to work about ten times longer to earn a litre of petrol or a kWh of electricity than we do at present, levels last seen in the 1920s. This will have profound effects on the construction industry. Among these will be:

• Everyone will concentrate on saving energy rather than saving labour. All machinery will cost a great deal more. Equipment will be repaired rather than replaced

• There will be little new building because of the high cost of the energy involved in construction. Instead the emphasis will be on adapting existing buildings.

• Low embodied energy materials like wood will come into their own. Concrete, steel and aluminium will become too costly for extensive use. Much higher insulation standards will be the norm.

• Transport will become very costly, so building materials will be sourced as close as possible to the site. The days of bringing heavy items like floor tiles from Italy and Brazil will be over. A very much more restricted range of materials and fittings will be available from most builders' suppliers.

• Very little earth-moving will be done. Road projects will come to a total halt. Giant distribution outlets of all sorts will close, to be replaced by neighbourhood shops and local distributors. Far fewergoods will be made and sold.

All in all, we are entering a period of profound change. What a shame that successive Irish governments ignored the warnings that it was coming. Had they done so, rather than joining in the near-universal pretence that the economy, and the fossil energy use associated with it, could expand for evermore, the country could have been much better placed to face it.

- kyoto protocol

- greenhouse emissions

- oil crisis

- european union

- Richard Douthwaite

- Climate Change

- fossil fuels

Related items

-

Property industry faces ‘triple threat’ from climate crisis

Property industry faces ‘triple threat’ from climate crisis -

Irish Green Building Council launch event to promote sustainable building practices

Irish Green Building Council launch event to promote sustainable building practices -

Ashden Awards winners showcase climate solutions

Ashden Awards winners showcase climate solutions -

‘Sufficiency’ key alongside energy efficiency & renewables, says IPCC

‘Sufficiency’ key alongside energy efficiency & renewables, says IPCC -

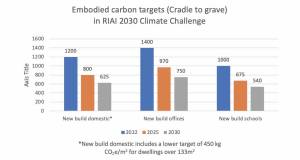

RIAI launches 2030 climate challenge

RIAI launches 2030 climate challenge -

Climate action plan sets embodied carbon targets for construction

Climate action plan sets embodied carbon targets for construction -

Grant invests in biofuel tech for oil boilers

Grant invests in biofuel tech for oil boilers -

Oil heating sector pivots to biofuels, but green groups raise concern

Oil heating sector pivots to biofuels, but green groups raise concern -

Architects call for urgent climate action ahead of COP 26

Architects call for urgent climate action ahead of COP 26 -

The PH+ guide to overheating

The PH+ guide to overheating -

Net zero carbon plans back renewables over fabric

Net zero carbon plans back renewables over fabric -

Building sector must show bold climate leadership

Building sector must show bold climate leadership