- Economy

- Posted

Bank on Expensive Oil

Ever since it first appeared, Construct Ireland has expressed the view that, as energy prices rise, well-insulated, energy-efficient buildings in locations with good public transport will sell more easily, and for better prices, than conventional, hard-to-heat buildings in places which make car use a virtual necessity.

We've also believed that buildings which permit low levels of energy use offer lenders better security. For example, a family with lower heating bills is better placed to pay its mortgage and the value of its house is more likely to be maintained in circumstances in which conventionally-built houses decline. The same arguments apply to commercial property – as heating costs rise, buildings which take less to heat per square metre should earn better rents. As a result, we've argued that lenders should offer those buying low-energy-demand buildings better terms. These could be slightly reduced interest rates or, perhaps, a slightly higher loan-to-disposable-income ratio.

Well, now that oil prices have reached over $140 a barrel, were we right? The answer seems to be that the big rise in energy costs has been so recent that lenders have not yet adjusted their offerings while the buyers' response can scarcely be detected because there's so much else going on in the property market at the moment. Falling house prices, tougher mortgage terms, rising interest rates and declining consumer confidence are among the factors complicating their buying decisions.

Because oil prices are quoted in dollars, and the dollar has lost value in relation to the euro, it's hard for most people to get a feel for the extent to which energy prices have gone up except in terms of how much it costs to fill up the car or the home-heating-oil tank now in comparison with the figure they remember from a few years ago. And, of course, as their incomes have gone up over that period, they need to allow for that too to get an idea of how prices have moved in real terms, in relation to their buying power.

As a result, until SEI brought out its Energy in the Residential Sector report in mid-June, many people did not realise that the proportion of the average household's income being spent on energy for heating and lighting was, until very recently, less than the 3.8% it had been in 1990 Indeed, up to 2002, the share of the family budget spent on energy declined year by year. Only within the last month or two has the proportionate spend returned to the 1990 figure. As a result, it's scarcely surprising that people – and banks – are only now beginning to become energy-cost conscious.

“I can only remember two people mentioning energy-efficiency when they described the sort of house they wanted” the woman who fields the initial enquiries at Lisney New Homes told me recently. “And one of those was last week.”.

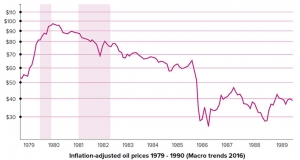

As Graph 1 shows, the price of oil in euros was on a plateau at around e15 a barrel between 1988 and 2000. It then began its rise and has now reached e90, 50% higher than the figure the SEI used when it calculated that in 2006 energy took 2.5% of the average family's budget. As a result, it's only now that the proportion of family income being absorbed by fuel has returned to the 1990 level.

Graph 1: The price of oil in euros up to the end of May, 2008. At the end of June, it had reached 90. This was roughly six times the level it averaged between 1988 and 2000.

Night-time traffic in Shanghai, China, where energy demand continues to increase as the country continues to develop

Several experts have predicted recently that oil is likely to reach $200 a barrel over the next six to 24 months, At the current $/e exchange rate, this would work out at e127 a barrel and, if all sources of energy move up in step, household heating costs could absorb 5% of family income, This would be a significant amount when compared with the 30-35% of disposable income that lenders typically allow people to borrow on a mortgage and could become the straw which breaks some camels' backs as jobs disappear in the economic downturn. True, it's much less in cash terms than the 2.75% rise in interest rates for which borrowers are said to be stress-tested to withstand. However, the stress-testing does not cover widespread and prolonged unemployment, circumstances in which the ability to manage on low outgoings becomes very important.

If we ask: “How much further up might energy prices go?” it's hard to come to a comforting conclusion. It is widely accepted that, unless there is a global depression, oil supplies will be inadequate to meet world demand for at least the next few years. Whether you think the inadequacy is because Western oil companies have made insufficient investments in the past and cannot make them now in key countries such as Russia and Iran, or because about half of the easily-produced oil has been used up already does not matter. The result is exactly the same: world oil production is probably as high now as it will ever be and output may begin to decline rapidly within the next thousand days.

Rembrandt Koppelaar, the editor of Oilwatch Monthly, says that world oil output could decline at anywhere between 8% beginning almost immediately and 2% starting in 2018. His projections are shown in Graph 2. He based the 2% figure on oil-industry estimates of “reserve growth” as a result of improvements in ways of getting oil out of the ground. The 8% decline figure was based on the doctoral thesis of Frederik Robelius of Utrecht University who looked at the rate that output from the 507 giant oilfields which supplied over 60% of world demand in 2005 was likely to decline in future. Another study, by Jeffrey J. Brown and "Khebab", suggests that exports from the five biggest producers are likely to fall at 6.2% a year, plus or minus 4%, and that these countries could be exporting nothing at all by 2031, plus or minus seven years. Such rapid rates of decline could push prices to extraordinarily high levels

An important thing to note about these studies is that the declines they project are similar or greater than the 3% year-on-year emissions reduction target set in the Programme for Government and the 20% cut below 2005 emissions levels by 2020 set for this country by the EU. Although the Commission on Taxation is currently considering the best way to achieve these emissions cuts, its options are limited to using a carbon tax, Cap and Share, or a combination of the two. Whatever they choose would put energy prices up above the level set by world markets if it was necessary to do so to achieve the cuts. It may be, however, that the depressed state of the Irish economy, or the high oil import prices, will bring about the cuts without state intervention.

Several of the people who forecast $200 oil talk of a price “spike” a term which implies that the price will drop back quickly again. They think that this will happen because the high prices are taking so much money out of consumers' pockets and transferring it to the OPEC countries and Russia that everyone's discretionary spending will fall. This will cut investment and jobs, causing the demand for energy to decline and its price to drop back. Others think that, while energy demand and incomes may decline and unemployment rise sharply in Ireland and other OECD countries, the demand for energy from China and India will be enough to keep energy prices at a high level indefinitely, especially as production drops

We therefore have a continuum of unpleasant possibilities, ranging from a booming world economy pushing energy prices higher and higher in terms of the length of time we have to work to pay for it as oil output declines, to a depressed domestic economy in which many people cannot afford to heat their homes properly because their incomes are insufficient for them to do so even though world energy prices have fallen below the level they are today. According to the SEI report, perhaps 15% of the population were already spending more than 10% of their incomes on heating when oil was a third of its present price in 2005 and could thus be defined as living in fuel poverty. That number must be much higher today and will rise even further as unemployment increases.

A 2nd generation pressurized boiler from Surface Power, which the company claim could greatly reduce heating costs

I can envisage no circumstances in which the proportion of the family budget needed for energy will be less than it is today. It is impossible to say where on the continuum we might find ourselves in two or three years' time but I believe the long-run position is clear: Irish incomes will fall in purchasing-power terms as our fossil energy use declines and the share that that energy takes of those smaller incomes will rise. This will mean that property prices will fall because the proportion of their incomes that people will be able to devote to paying a mortgage will decline.

Lenders have yet to take this type of thinking on board. They will find it hard to do so unless they change the way they work. One reason they have not offered better terms to those borrowing for energy-efficient buildings is that they don't believe that it's any business of theirs to say “We won't lend on a building in that area because you'd have the expense of running a car” or “We'll only give a 80% mortgage on that house because it's uninsulated and your outgoings will be greater”. They see their job as accepting the market's judgment on prices and the places to buy and, if their valuer says that the price agreed for the property is reasonable and the prospective borrower looks as though she can repay the loan, that's enough for them to take a positive decision and lend.

“Institutions refuse to lend in certain areas in the US” one mortgage broker told me. “It's called red-lining. It's not done here.” And it's just as well that it's not, because red-lining an area means that no-one can buy there and it gets locked into a cycle of continuous decline.

To what extent are the valuers the lenders employ taking increased energy and transport costs into their reckoning? Gerard O'Toole, from the Mayo agency Tuohy O'Toole, says that it is still unclear how much difference the recent rapid rise in energy costs should make. “We don't know yet what percentage difference there should be between the price of a house with a B energy rating and a similar one with a C” he says.

Fintan McNamara of the Irish Auctioneers' and Valuers' Association agrees. Although the IAVA will be running a professional development course for its members in the autumn on the Building Energy Rating requirements, he says it's still unclear what difference to price the various ratings should make. “It's too early,” he says. “Perhaps we'll be able to see in 12 months the value the purchasers are putting on the different ratings themselves.”

Oh dear. The phrase “the blind leading the blind” comes to mind. The public has been told almost nothing about the rate at which energy prices are likely to rise and, consequently, house-buyers cannot make an informed decision about where they should live, the type of property they should buy and how much they can safely afford. Their purchasing decisions are therefore based on current conditions and the belief that the future may be much like the past, not that the world is about to attempt a rapid transition to a new way of life. The prices that arise from these uninformed decisions are taken by the lenders as the basis for loans that stretch out for the next 25 years. There are parallels here with the sub-prime debacle: the assumption seems to be that, because everyone is lending this way, it's safe. However, since the lenders have, literally, billions at stake, shouldn't their economists be doing a reality check to see how their current lending terms will stand up as incomes decline and energy prices rise?

One or two financial institutions are offering loans at lower rates for energy saving or “green” energy production. For example, Permanent TSB has launched a website, www.greenloans.ie, which says that its "Green Loan actually rewards you for being environmentally friendly by giving you a special reduced-interest rate” to install insulation, double or triple-glazed windows, solar panels or woodchip boilers. The reduction is 0.6% on its normal personal loan rate of 9.9% for loans under e9,000 and a 1.2% reduction on its 10% rate for loans above that sum.

Ulster Bank will allow its mortgage holders in Northern Ireland to add £10,500 to the amount they owe to have photovoltaic panels fitted to their roofs by Solar Century. The interest rate is currently 3.71%, half the standard variable rate paid on the rest of the mortgage. If paid off over ten years, monthly payments come to £104.87 for the first three years and £118.53 thereafter. This gives an average annual interest charge of £373.18, quite a lot less than the energy savings one could hope to make at present power prices. If one used all the power oneself, the panels would cut £253 a year off one's electricity bill. If all the power was sold to the grid, the cheque from utility company would be £147, rising to £213 next year. Consequently, if one takes depreciation into account, one has to believe that electricity prices will more than double before this appears to be a good investment. The bank has apparently had few takers for the product which, understandably, is being sold on the basis that it cuts one's CO2 emissions rather than the likely investment return.

A much more ambitious scheme will be launched in the Republic later this autumn. Topline, a national chain of hardware stores been training its staff for over a year to sell a package for about the same price as the Northern Ireland scheme consisting of a pellet boiler, a well-insulated hot water tank and a solar collector. These, together with roof and cavity wall insulation if necessary, will be installed by independent plumbers whose training is about to begin. A well-known bank will offer finance to those buying the package at 2% less than its normal personal loan rate. Every house in which the package is installed will be given an energy rating afterwards as part of the deal.

A key element of the scheme is a carefully-worked out quality assurance and complaints procedure. “That's necessary” John Quinn of Surface Power, the renewable energy driving the scheme says, “as otherwise people might stop their repayments to the bank. Because the systems will only be installed by people we've trained, we can make sure things are put right if someone complains and, if an installer proves persistently unreliable, we will strike him off.”

According to Quinn, the scheme has been in development for over two years in terms of developing a suitably high quality of installer training. “It’s really about ensuring there’s a benchmark in terms of quality of installation, to ensure that the system operates in accordance with the consumer’s expectations”. Quinn maintains that work needs to be done to repair fractured consumer confidence in some of the emerging renewable energy technologies, and wood pellet in particular. “The deployment of wood pellet systems over the last few years has been lacking in the design and understanding of how they work. Existing rules for oil and gas systems in terms of installation were mistakenly applied to the installation of wood pellet systems. The mistakes were very simple and avoidable, but fundamental at the same time. This scheme will guarantee that the consumer’s interest are number one”.

The system should cut energy bills by 50%. “Just the switch to wood pellets will save you that over the cost of oil, and the solar water heater should cut 50% off your water heating costs. Improved insulation should do even more” Quinn said.

The average house with oil-fired central heating consumes about 1,800 litres of oil a year. At the June 2008 price of heating oil, 92 cents a litre, the switch to biomass should save about e850 a year if the expectations for the system are realised. If we allow e150 for the cut in electricity use, the system should reduce energy outgoings by around e1,000 a year. This is a much better current return than from the Ulster Bank's Northern Ireland scheme and, of course, the rate of return will increase as energy prices rise.

The fact has to be faced that the “green” loans from the Ulster Bank and Permanent TSB are merely loan marketing ploys. After all, Permanent TSB offers a better rate to people buying cars, while the Ulster Bank offers the same discounted rate to other categories of customers. What neither bank has appreciated is that getting a loan for something which will cut one's outgoings is entirely different from taking one out to increase one's consumption.

Householders are going to need to borrow a lot of money to invest in making their properties more energy efficient over the next few years, Until lenders reflect the results of these investments in the prices that their valuers put on houses, and also accept that someone borrowing to save energy is a rather safer bet than his neighbour borrowing to buy a car, it will be hard to mobilise the amount of money required to move the housing sector to much lower levels of energy use.

Related items

-

Grant invests in biofuel tech for oil boilers

Grant invests in biofuel tech for oil boilers -

Oil heating sector pivots to biofuels, but green groups raise concern

Oil heating sector pivots to biofuels, but green groups raise concern -

Architects call for urgent climate action ahead of COP 26

Architects call for urgent climate action ahead of COP 26 -

New Leeds developer goes passive

New Leeds developer goes passive -

New retrofit finance available in Waterford

New retrofit finance available in Waterford -

Work underway on ‘crowd funded’ passive house

Work underway on ‘crowd funded’ passive house -

New property finance platform offers chance to invest in Dublin passive house

New property finance platform offers chance to invest in Dublin passive house -

New research finds air pollution particles in human placentas

New research finds air pollution particles in human placentas -

Why housing isn't viable

Why housing isn't viable -

A brave new world: Oil and architecture

A brave new world: Oil and architecture -

Passive house or equivalent - The meaning behind a ground-breaking policy

Passive house or equivalent - The meaning behind a ground-breaking policy -

District heating and passive house - are they compatible?

District heating and passive house - are they compatible?