- Blogs

- Posted

Buy, hold or sell

Recent analysis has suggested a slowdown in the property sector for 2024, but what impact might a drop in inflation have? Mel Reynolds runs the numbers.

This article was originally published in issue 47 of Passive House Plus magazine. Want immediate access to all back issues and exclusive extra content? Click here to subscribe for as little as €15, or click here to receive the next issue free of charge

This is the time of the year when crystal balls are dusted off again and market predictions made at the start of the year are re-examined. The sales market is awakening, and prospective buyers, sellers, landowners and developers are all looking at the market and wondering if it’s time to buy, build, hold or sell.

Media commentators have presented a subdued picture of the property sector so far this year. According to market watchers, 2023 saw very low volumes of land transactions in Ireland. Land purchase in particular, given current market headwinds, is seen to present an opportunity. So, what will happen to land values this year?

Land value

One of the ways a qualified valuer will assess the ‘fair value’ of land is the residual valuation method. This entails starting with the headline new house sales price, taking away VAT, ‘hard’ construction costs, professional fees etc., and a property developer’s margin. What is left, the residual, is the land value. This is a good guide to see if you are getting value (as a buyer or seller) when it comes to open market land transactions. Given the prevailing negative sentiment in the commercial market, one would think that the price of land should fall.

However, the residential sector is different, and land values may be set to rise. It’s reasonable to assume prices will keep increasing at current levels while inflation has now reduced significantly. As we will read, these dynamics have amplified effects on land value.

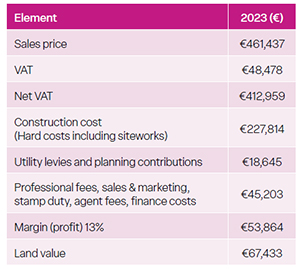

Table 1. Average cost of a new 3-bed semi-detached home in the greater Dublin area. (Source SCSI December 2023).

Table 1. Average cost of a new 3-bed semi-detached home in the greater Dublin area. (Source SCSI December 2023).

Typical house land value

The figures below are from the Society of Chartered Surveyors Ireland’s “The Real Cost of New Housing Delivery 2023” report from December last year, arranged in a residual format. As this demonstrates, a typical three-bed new home selling for €461,000 in the greater Dublin area today has a residual land value (site cost) of €67,000. Development levies are retained as costs, as the current waiver is a temporary measure due to expire shortly. Any reduction in cost leads to an increase in the bottom-line land value. See the breakdown in Table 1.

Developers frequently incorporate a ‘sensitivity analysis’, a ‘what-if’ scenario, into their calculations. These demonstrate what happens to values if prices or costs decrease or increase. Residual calculations are notoriously volatile and very sensitive to minor market movements. However, as we are moving towards an election in 2025, it’s reasonable to assume government policy will retain supply side measures and price supports such as the Help to Buy and First Home schemes, planning contributions waivers etc. In the following table we will make the following assumptions:

- Currently there is nothing to suggest any change in the trajectory of new home prices – we can assume a 10 per cent sales price increase this year (similar to the previous 12 months).

- Current industry estimates 3 per cent cost inflation – we can include this to all inputs for simplicity.

Assuming the above, the projected typical residual land value calculation for 2024 (a ‘what-if’ scenario) is as shown in Table 2.

Table 2. Projected average cost of a new 3-bed semi-detached home in the greater Dublin area to April 2025.

Sales, VAT and margin increase by 10 per cent, construction costs increase slightly (incl. levies) by 3 per cent, but most of the gain in price is reflected in the bottom-line land value. In this scenario the residual land value could increase by a whopping 40 per cent. This shows the amplified effects of price and cost fluctuations on the underlying value of land. In a falling market where sales prices reduce, the opposite reverse-leveraging can occur also.

Although anticipated construction output is expected to increase modestly, falls in bank interest rates coupled with increases in income may push prices higher. The land market may well see a pickup in activity if the price is right. So back to the question: buy, hold or sell? When it comes to market predictions, one person’s crystal ball is as good as another. The above scenario suggests that if you own land, time is your friend. If you are building, you may anticipate higher sales prices when you are completed this year. For prospective buyers however, time may be against you and new home prices may keep heading in only one direction.