- Feature

- Posted

Green shoots for green building

While tokenistic or poorly conceived attempts at supporting the decarbonisation and greening of buildings still abound in the finance sector, there are signs of structural changes on the horizon - changes designed to unlock widespread change. But do those changes go far enough?

While I was researching this article, I received a letter from my pension company, informing me my savings were invested in “companies positively aligned with the UN sustainable development goals” and that from the end of May they were going to “make it clearer … how the investments are chosen.”

Should I be impressed? Possibly not – they are almost certainly only following new regulations. It is, nonetheless, a sign of the times that they are now obliged to disclose more about where my “ethical” money actually goes.

Some of my pension is almost certainly invested in real estate. Property tends to increase in value reliably, and even if the value falls from time to time, it probably won’t vanish overnight the way a less tangible asset might. So, it is attractive to investors needing long-term security.

Like many savers, I tried to make at least some effort to choose a sustainable and ethical fund to put my money into. So, what are the chances that the property my pension is invested in, is clean, green and efficient, and not burning vast quantities of fossil fuel?

Pressure ‘from all round’

This article was originally published in issue 47 of Passive House Plus magazine. Want immediate access to all back issues and exclusive extra content? Click here to subscribe for as little as €15, or click here to receive the next issue free of charge

It is not just journalists with their little private pension pots who have these concerns. Attention to environmental, social and governance performance (ESG), is now a routine part of the appraisal of and by any large player in the financial market – including those who invest in, develop and own real estate.

As sustainable investment expert Csaba de Csiky, chairperson of EnerSave Capital explains, there are many pressures on investors and on building owners to improve the “green” performance of real estate. “There’s pressure from everywhere really, driven by regulation, labelling and target-setting and, ultimately, by public concern.”

Climate and energy performance is a particularly strong feature in ESG assessment in the property world. There are a number of overlapping reasons for this:

- Obligations to declare climate risk – which in turn, affect reputation and value;

- Concern and pressure from an increasing number of investors – affecting the availability of, and sometimes cost of money;

- Commercial benefits of energy efficiency: both the direct material ones like running costs, and the less tangible, but commercially significant, ‘desirability’ of premises that perform well and are associated with forward-looking design and tech;

- Risk of failing to meet legal obligations now or in future, leading to the possibility of a building becoming a ‘stranded asset’ shunned by the financial mainstream, which can only be let or sold at a much-diminished value.

The response of financial markets to the climate and other environmental crises is not necessarily especially altruistic. You could almost say it’s about keeping the show on the road.

The risks of not responding extend from the immediate hits to the bottom line, right out to the ultimately catastrophic end of everything. As Sebastiano Cristoforetti of sustainable construction consultancy Criscon explains, in the EU rules are being tightened “to move private capital towards lower risk by increasing competitiveness, and [to increase] capacity towards climate neutrality.”

The Smarter Finance for EU consortium, an EU-funded project aiming to unlock €100bn of certified green homes and tailored finance, includes (above) Alex Hedesiu of EnerSave Capital, Sebastiano Cristoforetti of sustainable construction consultancy Criscon, EnerSave Capital chairperson Csaba de Csiky (both pictured below).

A green building is a desirable building

Banks and financial institutions like robust third-party quality schemes like passive house, as they reduce risk.

In higher-end markets at least, low carbon emissions are part of a picture of ‘better’ building.

In theory at least, a greener building ought to have lower running costs, and attention to design might be expected to make it healthier and more comfortable to occupy as well.

Tenants and purchasers may also be looking for green premises for their own sake. If they are large or high-profile organisations, they may want to – or even be obliged to – report on the carbon footprint of their operations, adding to the marketability of green property. This adds up to a building that should be easier to sell or to fill with tenants.

Many people now believe this translates into cash value. Real estate services company CBRE says “there is an enduring benefit to rents from verifiable measures to reduce carbon emissions.”

The RICS Red Book tells valuers that sustainability and ESG matters “should form an integral part of the valuation approach.” Rafe Bertram, author of the Good Homes Alliance ‘Green Shift’ report told a Good Homes Alliance event in late 2023 that “energy efficiency is now having valuation bite”, and there is evidence this is becoming the case.

A green building is easier to raise money for

The greenness of a building, including its exposure to ‘climate related risks’, affects how easy or difficult it will be to raise money to buy or build it.

A long-term risk of asset stranding is a commercial risk in the here and now, once it is disclosed. And the rules on disclosures are increasing.

Lenders, investors and their advisors will take a view on how much they are willing to tie up in an asset if it’s not very green or is exposed to the risk of becoming unpopular or even ‘stranded’. Less money, and possibly only more expensive money, may be forthcoming.

Requirements, rules and ratings

There are many – and increasing – numbers of obligations on companies to make disclosures about the ‘sustainability’ of their assets and operations. Some apply to all corporations above a certain size, some specifically to real estate owners and investors, some are trans-national, and others more local. On top of the obligations is a densely forested ecosystem of targets, ratings, assessment tools and classifications, again, applying in different places and to different kinds of entity.

Sebastiano Cristoforetti of sustainable construction consultancy Criscon

TFCD requirements

Probably the best known of the rules on disclosure are those set up by the Task Force on Climate Related Finance Disclosure. While the recommendations of the task force itself were voluntary, UK and EU governments have legislated for larger companies to make mandatory disclosures.

The TCFD covers two categories of climate risks: transition risks and physical risks.

Transition risks are commercial, relating to how well you are prepared for anticipated regulatory and market changes. For these risks to be credible you do need to believe regulation and expectations will become more demanding. But this is something that is happening in most places, even if not as fast as some of us might wish.

Physical risks relate to the physical impacts of climate change: for example, extreme weather events such as overheating, flooding and storms damaging the actual assets, or the operations of the building occupants.

A plausible TCFD report is not in itself proof that a company is doing all it could and should to tackle climate risk. According to Nicola Stopps of consultancy Simply Sustainable, writing in the Financial Times’ Sustainable Views newsletter, “while the introduction of the TCFD has been a catalyst for making climate change risk a board issue, it does not exempt companies that submit to TCFD from continuing to contribute to climate change in a significant way.” She explained that it is perfectly possible to publish a “technically sound” TCFD report, yet for instance, be a major fossil fuel investor.

TCFD declarations can appear a bit opaque and subjective, even complacent. But they really are just a baseline, and many investors are already seeking much more detail.

They also want to know they can believe the information they are given.

Greenwashing

Wherever there is a commercial advantage in doing something extra, there will be those who try to claim the advantage without doing the work. There have been awkward ‘greenwashing’ scandals in sustainable investment: “Some companies have been ‘named and shamed’ when a green claim is challenged on social media for example,” Alex Hedesiu of EnerSave explains. While the damage falls hardest on the commercial value of the organisation that has been “found out”, the risk is that the whole sector loses value, because credibility is lost.

In response, regulations around disclosure and labelling are becoming much more exacting. The EU’s Corporate Sustainability Reporting Directive (CSRD) is already in force, with a first report due in 2025, and the UK’s Financial Conduct Authority’s anti- greenwashing Sustainable Disclosure Requirement (SDR) – which I suspect drove the letter from my pension fund – both look for a lot more detail.

These regulations also mean real estate organisations can no longer publish information about their financial status without also disclosing their environmental impact as well.

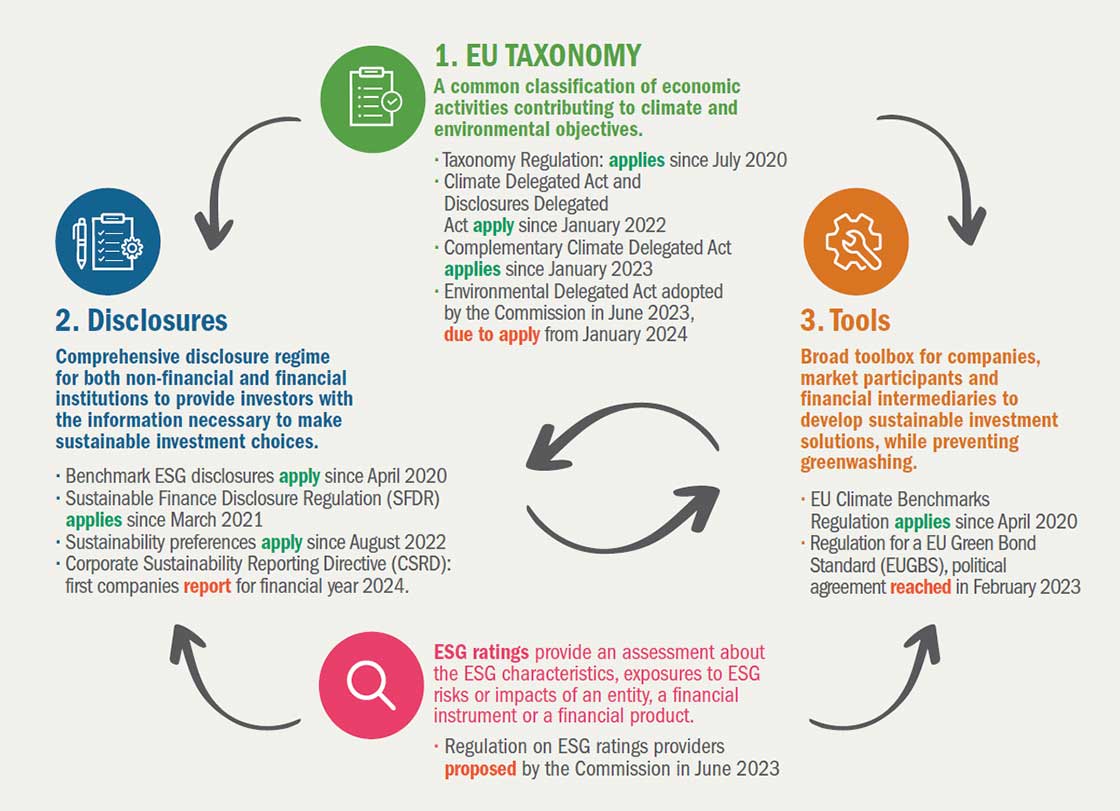

The EU has designed a system where this information supports reporting under the Sustainable Finance Disclosure Regulation (SFDR), which requires financial market participants and financial advisors to report accurately on ESG performance.

The CSRD requires detailed reporting on calculated emissions, and detailed plans of how they are going to be reduced. This is quite an upgrade on its predecessor, the Non-Financial Reporting Directive (NFRD), which only required imprecisely defined “information”. The CSRD also affects around four times as many bodies as the old NFRD.

EnerSave Capital chairperson Csaba de Csiky

The CSRD also defines levels of commitment to ESG goals, with only a few “green” funds so far having met the highest level, where ESG is genuinely a “core goal”.

Both the UK and EU regulations will thus now require disclosure of not just how climate change may affect a business (including its suppliers and its assets), but how that business’ operations are likely to affect the climate.

What actually counts as a green property investment?

In the EU, what constitutes a green property investment is specifically defined in the EU taxonomy for sustainable activities, which is closely interlinked with the CSRD and SFDR. The taxonomy basically defines in some detail whether an activity can be classified as sustainable, in line with the EU’s net zero trajectory by 2050 – and the bloc’s broader environmental goals other than climate.The taxonomy sets six environmental objectives:

- climate change mitigation

- climate change adaptation

- sustainable use and protection of water and marine resources

- transition to a circular economy

- pollution prevention and control

- protection and restoration of biodiversity and ecosystems

To qualify, an activity must contribute to at least one of these six objectives, and must do no significant harm to any of the others, while respecting basic human rights and labour standards.

The taxonomy gives investors valuable information about an asset that might otherwise be hard for them to find. Sebastiano Cristoforetti explains that ESG is on companies, not projects, and information gets partly lost, if it comes from the technical side (such as projects and buildings). People involved in the investment side often do not have technical knowledge, so “a common technical ground is needed, and the EU taxonomy is the cornerstone of a new approach”.

In the requirements for construction of new buildings it states that "to be eligible for classification as green, the design and construction of new buildings needs to ensure a net primary energy demand that is at least 20 per cent lower than the level mandated by national regulations. This is assessed through the calculated energy performance of the building.”

Renovations must be designed to meet the local, national or regional requirements for ‘major renovation’ as defined in the Energy Performance of Buildings Directive (EPBD), or alternatively at least a 30 per cent reduction in primary energy demand.

There is no such definition specific to the UK – however, most of the larger financial institutions that operate in the UK are trans-national, so will be well aware of the EU taxonomy and the additional clarity it brings.

Show us the data

If an asset loses enough value due to its poor performance as green credentials start to make a difference, alternative sources of money may step in.

So far, so encouraging. However keen-eyed readers will have spotted that even with the strict new reporting requirements and the EU taxonomy, the standards set are defined only by predicted performance of a building.

And as is well known, when a building’s performance is predicted by something like the UK’s energy performance certificate (EPC) or Ireland’s building energy rating (BER), that prediction may well be wrong.

At the 2023 GHA event on financing green construction, delegates expressed concern about inaccurate predictions of performance – pointing out that investment companies are aware that EPCs are not that useful, so are keen to use more accurate indicators, including post occupancy assessment.

As one delegate asked: “Will stakeholders be willing to take the risks if the benefits are miscalculated?”

One solution to the fears of unrealised promises is to adopt better modelling approaches than simply EPCs. Green real estate investment expert Steve Fawkes of EnergyPro says banks and financial institutions like robust third-party quality schemes like passive house, as they reduce risk. He adds that because the improvement in performance with passive house is just so much bigger, there is much less chance of missing decarbonisation targets. “If we could get banks to recognise this it would definitely help.”

A few green property investment funds are already responding to the data challenge by requiring metered data from the properties in the portfolio. Steve Fawkes applauds this. “I do think that a major driver is investors increasingly wanting, and being pressurised, to have real performance data on all ESG factors rather than proxy data like EPCs.”

Advances in data technology are making data collection and analysis easier. There are still issues of cost, interpretation and privacy. (How much difference do the activities of the occupants make to the apparent performance of a building, and how much is it legitimate to know about those activities?) But overall, digital technology makes it easier to communicate real world information.

This is something “the interaction between stakeholders at all phases of construction projects … can benefit from,” Sebastiano Cristoforetti and his colleagues believe. Cristoforetti is working with Hedes and de Csiky of EnerSave as part of the EU Lifefunded project Smarter Finance for EU, which aims to unlock the finance and certification systems to deliver €100bn worth of green homes.

Describing the status quo as “green"

Sadly, if you are not actively building or retrofitting an asset, it may still enable you to use some ‘green’ descriptors merely by having a reasonably good EPC for its date. In the UK at least one investor has boasted that its portfolio is getting greener – merely because it comprises pretty much entirely new builds. In other words, the portfolio performance has merely tracked the tightening up of the building regulations.

The Loan Market Association – which covers sixty-five countries in Europe, the Middle East and Africa – published the Sustainability- Linked Loan Principles (SLLPs) in 2019, offering guidance on sustainability- linked loans (SLLs). In order to move towards more meaningful guidance, the association updated its SLLPs in 2023 and set specific performance targets (SPTs), which it said should be “ambitious, material and quantifiable”, and must go beyond regulatory requirements.

Such an approach means that new buildings tend to rate higher, and this is true across the EU as well. In most places, a portfolio of newly constructed buildings is likely to appear “greener” than a portfolio of existing buildings – even those that have had good retrofits – because the EPC scores of the latter are unlikely to be as high.

ESG-driven finance for retrofit may thus be harder to raise. While it is accepted that high-consuming buildings risk becoming low value “stranded assets”, these assets are generally still sitting on sites that people want to occupy. This may lead to the perverse consequence that it is easier to use ESG finance to demolish and redevelop an existing building, than to retrofit it – despite the fact that in most cases, a full life cycle analysis would show this is far less “green” an option.

The technical annex to the EU taxonomy accepts this contradiction needs to be tackled: “there may be a risk of undermining renovation efforts if financing acquisition becomes less onerous than financing energy efficiency measures. For this reason, the Technical Experts Group recommends introducing a requirement to renovate assets … that have long tenure periods”.

The business case for retrofit can be hard to prove, says Cristoforetti. Buildings must be available in the right location and at a sufficiently low price to make the renovation investment viable for developers and their lenders.

“The investment timespan can then be relatively short and justified by price increase, demand and a project’s appeal,” he says.

Cristoforetti adds that when owner occupiers choose retrofit, savings and increased quality of life are generally key factors, with an increase in equivalent income crucial for lenders. But the financial return for households tends to be on a much longer period, and borrowing capacity can be a challenge for large parts of the population, if more capable stakeholders do not take a leading role. If an asset loses enough value due to its poor performance as green credentials start to make a difference, alternative sources of money may step in. Csaba de Csiky explains that at this point a building may be unattractive to conventional investors – and private equity firms may buy them for a low market price and attract ‘high risk high return’ investors to finance the upgrade, at which point the asset could be ‘flipped’.

It is possible that a more proactively sustainable approach could step in. One ‘alternative investor’ fund at least has just been set up to bring in higher risk alternative capital, combining it with quite ambitious carbon reduction measures.

Longer term, it may be that a way around this is for the labelling and benchmark systems to incorporate life cycle assessments – and not just to refine a pre-determined action, but to guide the fundamental decisions on what to build where, and whether to demolish or retrofit. This is not something that is, for the most part, currently required.

Some of the shortcomings in the way ESG goals are communicated to the property industry, mean that in many markets – especially those away from the high-end, high value, big city towers – the ESG revolution is not yet strongly felt.

The turnover of property is slow – we want buildings to last, after all. And the fact that a property investment can often be classed as green when it is simply directed towards a regulations-compliant new building, that performs well in modelling, dilutes the impact too.

While the standards may not yet be asking for enough uplift over the legal minimum, and while tools to do the measuring may not yet supply enough relevant information, the tools are in place, and the investment world has developed a whole new operational culture to accommodate them. In finance there is always competition to be soundest – and ‘green’ is now ‘sound’. Some of the most ambitious “green” property funds are doing very good business. We just have to hope the rest scramble to catch up and overtake them.