- Blogs

- Posted

A housing boom without the houses?

There was much talk of jobless recovery as economies picked up after the last global recession. Mel Reynolds detects signs of an analogous proposition in the Irish property market: a housing boom that may be close to peaking without much in the way of housebuilding to report.

This article was originally published in issue 28 of Passive House Plus magazine. Want immediate access to all back issues and exclusive extra content? Click here to subscribe for as little as €10, or click here to receive the next issue free of charge

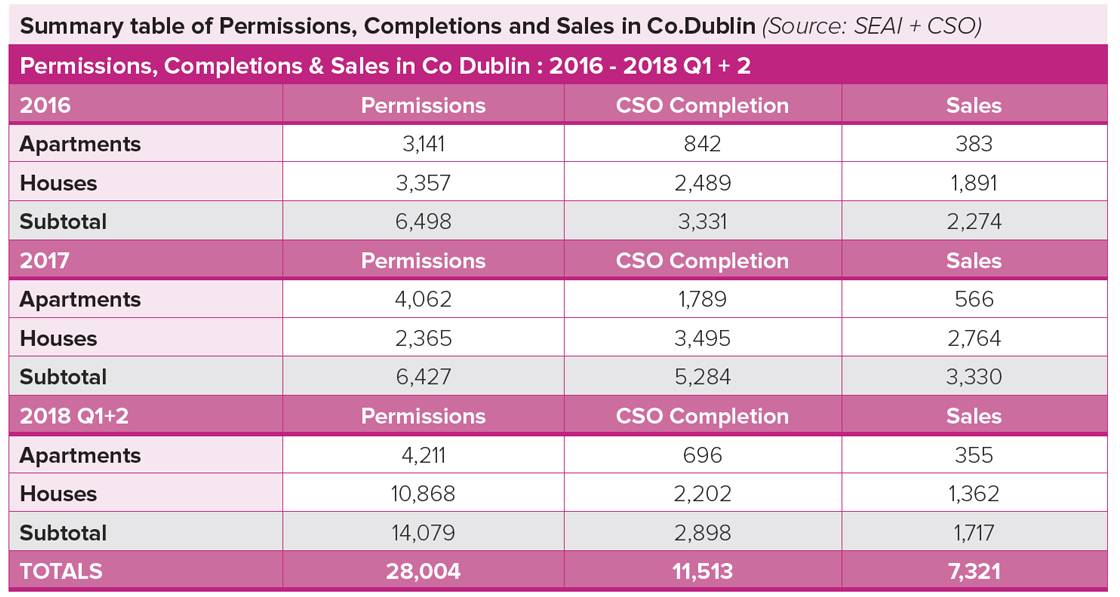

A veteran builder once told me “development is like musical chairs; if you are standing when the music stops, you are finished”. �This article will examine current housing trends in Co Dublin. � The table shows indicators of new home activity from 2016 to the second quarter of 2018.

Planning permissions

The Central Statistics O�ffice (CSO) publishes an array of detailed information on new housing including planning permission data. Since 2016 in Co Dublin, 16,590 new estate homes and 11,414 apartments have been granted planning permission, a total of 28,004 units. Levels are increasing, leading many to assume that “activity in the construction sector is clearly now ramping up aggressively. Permissions are a valid but not reliable indicator of activity. For various reasons up to 40% of schemes never get built, the so-called ‘permissions gap’. Completions and sales are accurate supply and demand metrics.

CSO ‘derived ESB’ completions

The CSO has recorded 8,186 new homes and 3,327 apartments completed in Co Dublin since 2016, a total of 11,513 dwellings. Just 41% of planning permissions granted have been built in the past two and a half years and 27% of new estate homes and 60% of apartments completed in this period remain unsold. ‘Overhang’ stock is increasing year-on-year.

Completion figures are 27% greater than BERs issued and may still be slightly overstated. In 30 months, four Dublin local authorities have issued final BERs for 9,063 new dwellings. BERs are required by law for all new homes prior to occupation, sale or letting.

This difference suggests illegal conversions and long-term vacant homes held by lenders as a result of arrears resolution, so-called ‘ghost’ arrears units, may be included.

According to the Central Bank there are 3,000 homes vacant for more than three years in the latter category. New owners or tenants will need to apply for a new meter number (MPRN) on re-occupation, resulting in these existing homes being incorrectly counted as new homes. Social housing activity is at very low levels. Local authorities and approved housing bodies completed just 153 new social homes in the first half of this year in Co Dublin.

New home sales

The CSO also records residential sales, whether new or second-hand, individual homes or block purchases by funds, as stamp duty transactions. ‘Build-to-let’ developments, where an owner builds-out a site and retains ownership, will not be captured, as no asset transfer has occurred. However, there has been little ‘built-to-let’ activity in the past three years.

New dwelling sales appear flat compared to last year and residential lending has stalled. In Co Dublin 6,017 new homes and 1,304 apartments have been sold, a total of just 7,321 dwellings in two and a half years. This is significantly lower than permissions or completions and a fraction of even the most conservative demand projections.

The state is very active in the new home sector, both building and buying. Since 2014 in Co Dublin, 5,721 new homes – more than 40% of all new sales – were dwellings funded by Nama (5,721 homes funded by NAMA since 2014 - “Dail: Written Answer on: 13/11/2018 Question Number(s): 179 Question Reference(s): 46750/18 Department: Finance.”).

Out of the 3,330 new homes sold in Co Dublin last year, local authorities and approved housing bodies purchased 11.4%, 382 so-called ‘turnkey’ units. Most Nama funded homes are unaffordable and the state competes with ordinary buyers for new build purchased units.

Is the music slowing?

Planning permissions should not be used by officials as an indicator of building activity. In Co Dublin up to 60% of permissions were not built over the past thirty months. Of units completed, one-third remain unsold. More than half of new apartments remain as ‘overhang’ stock. Recent ‘bulk-sales’ of new schemes to institutional investors may be symptomatic of lower than expected demand.

Finance, affordability and consumersentiment are contributing factors to sluggish sales. Land speculation, cost inflation, low margins and continued planning policy changes are head-winds stalling industry momentum. Commercial uses such as office, hotel, student/co-housing are more profitable than residential in many locations. Increasing height caps will not persuade developers to build expensive high-density schemes that are difficult to sell.

Issues remain with how Department of Housing officials present housing activity. In Co Dublin in thirty months from 2016 to Q2 2018, new home sales are just one-quarter of the total of permissions granted. House-building is a cyclical industry and it is essential to have an informed view to plan ahead. Other than cash-rich private equity funds or Nama, few have the capacity to carry built schemes unsold for prolonged periods.

The builder also said, “no-one knows when the music is going to stop”.