- Renewable Energy

- Posted

Full Circuit

Planning ahead for Ireland’s electricity supply is by no means a simple matter, given the range of unprecedented issues that are coming to the fore. Massive cuts in emissions must be achieved, whilst decisive action is required to ensure adequate supply of electricity at a time when usage is spiraling. Richard Douthwaite explains the balance that Ireland must achieve between efficient local generation and usage and ensuring optimal interconnection to global renewable electricity supply

It's not quite schizophrenia but two very different visions of how Ireland's electricity might be supplied in future are being backed by different government bodies. The two are not necessarily incompatible – indeed, we are likely to see a combination of both. The problem is that, at present, the effect that one might have on the other is not being taken into account.

On the one hand, there is the approach being taken by SEI with its Sustainable Energy Zone project in Dundalk. There, an area of around 4 sq km is being used to demonstrate how much energy can be saved, and how much provided locally, in a normal community with housing, a college (Dundalk Institute of Technology), a secondary school, a hospital, leisure facilities, an industrial park, shops and hotel and office accommodation. The energy savings will come from retrofitting existing buildings and from the installation of smart electricity meters.

“It's always our policy to go for energy saving first. Renewables come after that” says Declan Meally of SEI. Even so, a windturbine is already in operation on the DkIT site and there are plans for a community energy services company (ESCo) which will operate a woodchip-fired district heating system and supply at least 20% of the area's heating needs by 2020.

To some extent, the ESB is aligned with SEI's approach. It says that almost half of the e22 billion capital spending it announced in March will be used on building what it calls a “smart network”. This involves changing the distribution side of the grid so that it can support micro generation at domestic level. “At the moment, the distribution grid is hierarchical and only allows power to flow downstream”, Kevin MacDermott, an ESB press officer, says. “A smart grid will allow power to be exported from home turbines, solar panels and micro combined heat and power (CHP) when not being used by the householder.”

The other approach is the traditional one. Rather than working on the basis that each community will minimise its energy use and produce as much power as it can from its own resources, it assumes that electricity, even the renewable kind, will continue to come in bulk from distant sources. It also assumes that the demand for electricity will continue to grow despite energy saving measures and the likelihood of higher real prices. As a result, the Department of Communications, Energy and Natural Resources' All-Island Grid Study, which came out in January, anticipates that the amount of electricity consumed in the whole of Ireland in 2020 will be 54TWh, 40% higher than it is today, and that all this would have to pass through the transmission grid. In other words, the potential contribution of local-level microgeneration is ignored.

Moreover, the study either forgot about the Department's own plans to have ESB Networks install a smart meter on every consumer's premises or assumed that the meters will have no great effect in smoothing out the load. This is consequently assumed to vary between a minimum of 3500MW to a maximum of 9600MW. It is this near-doubling of peak demand over the 2007 figure, 5,077MW, which makes it necessary for much of the new grid capacity to be built.

DKIT’s wind turbine

One of Imera’s lines will run past Airtricity’s Arklow bank wind farm to Dinowig power station, Llanberis

If these and similar assumptions are not challenged, very large sums will be spent on developing the national grid. Eirgrid has already been told already by the electricity regulator that it can spend up to e520 million on developing the transmission side of the grid between now and the end of 2011. This does not include the cost of the 500MW interconnector it wants to build to link the Irish grid with the British one. The bill for this is expected to be about e420 million by the time it is in place in 2012, including e90 million to upgrade the powerlines running to the Woodland transmission station in south County Meath where the interconnector will join the national grid. Eirgrid also wants to build North-South interconnector before 2013. This will link the Northern Ireland grid more strongly with that in the Republic and will cost between e150 and e180 million.

Eirgrid maintains that the main reason for building it is to improve the working of the All-Island electricity market rather than to increase transmission capacity. The market meets the demand for power by buying it from whichever generating companies are the cheapest in any given half-hour period. It ought therefore to be possible, so the argument goes, for savings to be made if Northern Ireland generators can bid to sell their power because the interconnector allows their output to be moved to wherever it is required.

Electricity consumers may not benefit from this increased competition, however. Whether they do or not depends on whether the fall in the average price at which power is bought is sufficient to cover the extra charge that has to be made to cover the cost and the maintenance of the interconnector.

Eirgrid's other investments will also increase the cost of operating the grid and unless the demand for power increases in step with that cost, the charge collected per unit for passing power through it will have to go up In other words, if the electricity regulator gets things wrong (and it is the regulator who approves Eirgrid's capital spending and then says how much extra it can charge for running the grid) electricity consumers will face higher bills because of the cost of the surplus grid capacity.

As in any business, Eirgrid and the regulator are trying to hit a moving target. For one thing, technology is changing. A new approach, flexible alternating current transmission systems, or FACTS, uses high-current and high-voltage electronic devices to increase the carrying capacity of transmission lines. This might make the proposed new lines unnecessary even if demand grows as predicted. FACTS also improves the reliability of a system by reacting very quickly to grid disturbances.

Other movements come as a result of competition. Last December, a private company, Imera, was granted a licence by the UK electricity regulator Ofgem to build two electricity interconnectors between Ireland and Wales. The company now has a planning application before An Bord Pleanala under the Strategic Infrastructure Act. It hopes to get the Irish consents for its first line, which will run between Arklow and North Wales, by the Autumn and to have it in operation in the first quarter of 2010. The second line, which will run from Great Island, County Wexford to South Wales, is planned to open at the end of 2011. This means that both lines, which together will have 700MW capacity, will be in operation before the 500MW Eirgrid one. The question has to be asked: should Eirgrid still go ahead? Its route is longer and costs e80 million more than the e340 million that Imera is budgeting, despite the fact that it has less capacity.

Dinowig power station, Llanberis

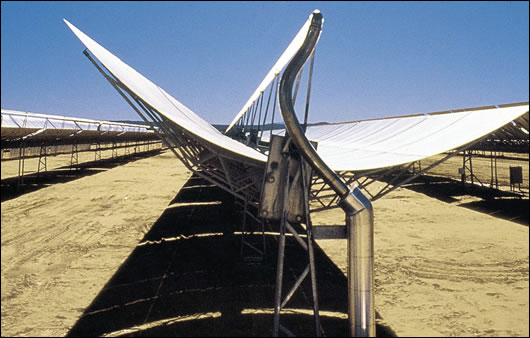

Concentrating Solar Power (CSP) plants, harness the sun’s heat using curved mirrors to heat a pipe through which water flows, and if built in North African deserts could

meet the energy demand of the EU

“The projects don't undermine each other” says Michael Kelly of Eirgrid. He explains that the Eirgrid line would have open access. Anyone dealing in electricity would be able to use it for a fee while the Imera lines would not be obliged to act as common carriers. Imera, for its part, fears unfair competition. “Eirgrid will own its interconnector. It is also Ireland's transmission system operator. Whose line do you think it will use when it wants to import and export power?” says Imera's chief executive, Rory O'Neill who is based in Dublin. Imera itself is a subsidiary of Oceanteam, which developed to supply offshore services to the Norwegian oil industry and which now has most of the big-name international investment banks as shareholders.

In fact, much of the traffic through Imera's interconnectors may be its own. Its Arklow line will run to Dinowig power station, Llanberis, the largest pumped storage facility in Europe. The plan is to buy Irish wind electricity when it is cheap and to sell it in Wales, and then to buy electricity from the Dinowig store or the British grid when it can be profitably sold in Ireland. The line will run close to both the Arklow Bank, where Airtricity has its offshore wind farm, and the Codling Bank, where consents have been given for more offshore turbines.

The location of its second line is good too. If the oil-fired, 1967-vintage Great Island power station in the Waterford estuary closes as planned in 2010, the Southeast will be without any generating capacity and the new line will play a valuable role in strengthening the supply to the area. The two lines together are capable of meeting 14% of Ireland's current electricity demand. “We'll give voltage stability and, as the interconnectors will have blackstart capability, we can help the system recover very quickly after an outage” O'Neill says.

Imera may upset Eirgrid's plans for the North-South interconnector too. It has made a detailed offer to build that 70km line entirely underground in 18 months at no upfront cost to the state and to get the e320 million it would cost to build back on a “regulated return basis.” This would involve it agreeing with the regulator the rate of return it should get on its investment and setting the charge for transmitting power to produce that. “We would not have the ability to earn any excess profits” O'Neill says.

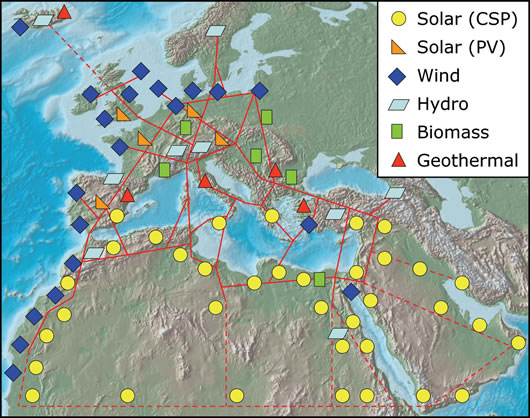

This map from Desertec shows how a renewable energy grid connecting Europe, the Middle East and North Africa, could take shape

A 150 megawatt CSP plant in the Mojave desert, California. This facility is one of three separate sites within 40 miles of one another. Together these three facilities can generate about 354 megawatts at peak output, comprising most of the commercial solar ower currently produced worldwide.

Many people along the route of the line would welcome it being underground, and the Department of Energy appointed an international firm of consultants, Ecofys, to look into the possibility in April this year. Eirgrid is very much against an underground line because it says it would be harder to locate any problems and get to them. It also dislikes the fact that the Imera line would carry its power as direct current, just as the cross-channel interconnectors will do, whereas an overhead interconnector would be alternating current like the rest of the transmission grid. This, it is said, would enable it to react to supply and demand changes more promptly because it would be directly linked to every other AC power line in the country. It would also be a more flexible solution as it would be possible to connect other power lines to it anywhere along its length.

In the longer term, having the two Imera interconnectors to Britain and the Eirgrid one may not provide too much capacity even if electricity demand stabilises. This is because Ireland is likely to close down several of its fossil fuel generating stations in response to high fuel prices and the threat of climate change and develop its renewable energy sources instead. Some of these sources, like wind, will obviously be intermittent and, when the wind drops and they prove inadequate to meet demand, the shortfall will be met by imports from elsewhere. This was Eddie O'Connor's idea when he was CEO of Airtricity. A study he commissioned showed that if a network of offshore windfarms was built off every coast from the West of Ireland to the Baltic, there would be very few occasions when power was unavailable because the farms would be in different weather zones. The Supergrid project to link the windfarms with undersea high voltage DC cables was born.

Although this project was very much O'Connor's baby, Airtricity's enthusiasm for it has not lessened since he left the company when it was purchased by Scottish and Southern last November. Chris Veal, who is the company's Supergrid director, says that he expects that a start will be made on constructing it from 2012 onwards when licences are issued by the Crown Estate for windfarms in the British section of the southern North Sea. Licences have already been issued for windfarms closer to shore than the sites to be released then but a supergrid is not required to serve them as it is only worthwhile converting the power to DC and then back again to AC for distances above 10-15km. He expects turbines with a total capacity of up to 25GW to be installed at a cost of £50-£75 billion. The supergrid component of this cost would be 10-15%.

This grid is likely to become part of an even bigger one linking countries all around the Mediterranean but designed primarily to enable electricity generated in the deserts of North Africa to meet EU demand. The amount of power potentially available from this source is quite startling. Each year each square kilometre of desert receives the solar energy equivalent of 1.5 million barrels of oil. Put another way, the energy delivered by the sun in North Africa every year is equal to that in a layer of crude oil of 0.25 meters thick over its whole land surface. This resource is several orders of magnitude larger than the current global energy demand.

It is proposed to capture the sun's heat by using curved mirrors to focus it on a pipe through which water flows. This generates steam which is used to power a turbine or a Stirling engine. There is nothing new about this “concentrating solar power” (CSP) technology. A plant using it has been working satisfactorily for two decades in an American desert and a 64 MW station, the largest CSP plant to be built in the US for 16 years, was opened earlier this year. At about the same time, Europe's first commercial CSP plant opened in Spain near Seville. This generates about 11 MW of electricity - enough to power up to 6,000 homes - but its operators hope that it will eventually produce sufficient power to meet the needs of Seville's 600,000 residents.

The estimated cost of a Europe, Middle East and North Africa-wide HVDC supergrid comprising 20 transmission lines of about 5 GW each is about e45 billion, which seems very low until you remember that it does not include the cost of the CSP installations. Figures given to a British parliamentary committee put the approximate cost of two 5 GW transmission lines between North Africa and the UK at about £5 billion, “shared among several countries and spread over many years”.

The power itself would cost about 7.5 eurocents per kWh at its station in the desert and roughly 10% of it would be lost in line losses before it reached Ireland. No problems are expected in meeting power needs at night – the heat would simply be stored in molten salts and these would heat the steam when the turbines needed it.

The project is a very attractive alternative to nuclear energy and is being promoted hard by the German chapter of the Club of Rome. It seems to be gaining support. The French Government is reported to be particularly keen as it would boost its “Union for the Mediterranean”, a proposed community of European Union member states and countries bordering the Mediterranean Sea suggested by the French President Nicolas Sarkozy as an alternative to Turkish EU membership. Turkey would instead form the backbone of the new grouping.

A hybrid between the two visions of Ireland's energy future could look like this: recent evidence indicates that the world is warming much more rapidly than expected and that serious emissions cuts need to be made within the next three years if a runaway warming is not to develop. European governments therefore decide to phase out fossil-fired power stations more rapidly than they currently think possible. They look around desperately for an energy source to replace them. The power-from-the-desert plan appeals to them strongly, particularly as it will create a bonanza for the investment banks that are already backing Imera and for European equipment manufacturers such as ABB which makes the undersea cables.

But, by the time it gets to Ireland, the Supergrid power will be expensive. As a result, since the money paid to import it will be a drain on the economy, the government here decides it should only be used for power-hungry factories and in the bigger cities where people lack other renewable energy options. Elsewhere, people should keep money and jobs in their local economy by generating their own power. This could be either on a household level or as a community using a vehicle like the energy service company (ESCo) that SEI is setting up in Dundalk. Indeed, if the regulator gave permission, parts of the existing electricity distribution network could be turned into largely self-reliant local grids. These would be linked to the transmission grid but would treat it as a back-up, buying in its expensive power only when there was no local alternative.

For such a hybrid to emerge, a balance needs to be struck between the capital-intensive, top-down, let's-link-up-Europe-and-North-Africa solution and local, bottom-up, let's-use-our-own-savings-to-develop-our -own-local-power-supply one. Both will be needed but it's impossible to know at the moment whether the government is getting the division of resources between them right. A serious problem is that the ESB has given only a very sketchy breakdown of how it will spend its e22 billion. The only documentation publicly available is the PowerPoint presentation given at the media launch. As a result, we can't say whether the e9 billion or so that it plans to spend on making the distribution grid suitable for microgeneration might not be better spent on laying a cable to the Sahara.

What's certain is that there needs to be a lot more public debate. The infrastructural investment decisions being made now are likely to have a much more profound effect on this country's future than, for example, whether Clinton or Obama gets the Democratic Party's nomination.

- Articles

- renewable energy

- Full Circuit

- douthwaite

- Feasta

- energy

- electricity

- Eirgrid

- Imera

- Strategic Infrastructure Act

- Llanberis

Related items

-

The world energy crisis 2022

The world energy crisis 2022 -

Grant heat pumps at centre of NI energy transition project

Grant heat pumps at centre of NI energy transition project -

SEAI Energy Awards 2020 open for entries

SEAI Energy Awards 2020 open for entries -

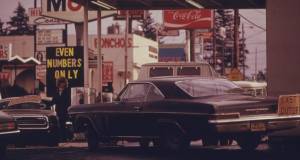

The first oil crisis

The first oil crisis -

The Jodrell Bank grand challenge

The Jodrell Bank grand challenge -

SEAI Energy Show back at RDS on 27 & 28 March

SEAI Energy Show back at RDS on 27 & 28 March -

Energywise Ireland open new renewables showroom

Energywise Ireland open new renewables showroom -

Together in Electric Dreams

Together in Electric Dreams -

Use all your solar electricity at home rather than export it — Warik Energy

Use all your solar electricity at home rather than export it — Warik Energy -

SEAI Energy Show to take place on 6 & 7 April

SEAI Energy Show to take place on 6 & 7 April -

Passive House Plus editor explains passive house to RTE's Eco Eye

Passive House Plus editor explains passive house to RTE's Eco Eye -

Passive House Plus back issues now freely available online

Passive House Plus back issues now freely available online