- Blogs

- Posted

Are lower land values the silver lining of the crisis?

While the Covid-19 crisis has undoubtedly caused a huge amount of human suffering and economic damage, it has brought some upsides too. Mel Reynolds speculates on how much land prices may fall, and what the positive and negative impacts may be.

This article was originally published in issue 34 of Passive House Plus magazine. Want immediate access to all back issues and exclusive extra content? Click here to subscribe for as little as €10, or click here to receive the next issue free of charge

Where to for the construction sector now in 2020? Given the changes to the world landscape this year, the housing sector outlook is very different. Construction sector overheating, skills shortages and increasing prices are looking like yesterday’s problems.

There have been a plethora of uncertain industry predictions for the year ahead. Uncertainty rules the day and it is widely accepted that prices and activity will be affected.

A report by Davy Stockbrokers suggested that new house prices in Ireland could fall by as much as 20% and land values by up to 50% if the economic upheaval caused by the virus continued. A Knight Frank report suggested that new homes output may fall by as much as 40% this year. In 2009, the worst year of the previous crash, prices dropped by almost 20% so some predictions may be overly pessimistic.

What remains unknown is the extent of the fall and how long this upcoming recession will last. Pre-crisis, industry consensus was that one of the biggest impediments to affordable housing was the cost of land. Other than a relatively small drop in sales prices, are there any positives in the current crisis?

Residual site values

The common way of valuing development land is the ‘residual’ appraisal approach. This starts with anticipated sales prices and then subtracts all costs (development, financial, construction cost), and an allowance for profit of between 10 and 20%. The remaining figure is the ‘residual’ value, the price that developers will pay for development land. Increases in sales price or cost savings add to the bottomline site value. In a rising market developers may pay more than this figure, booking anticipated price rises. In a falling market a more conservative view may be taken.

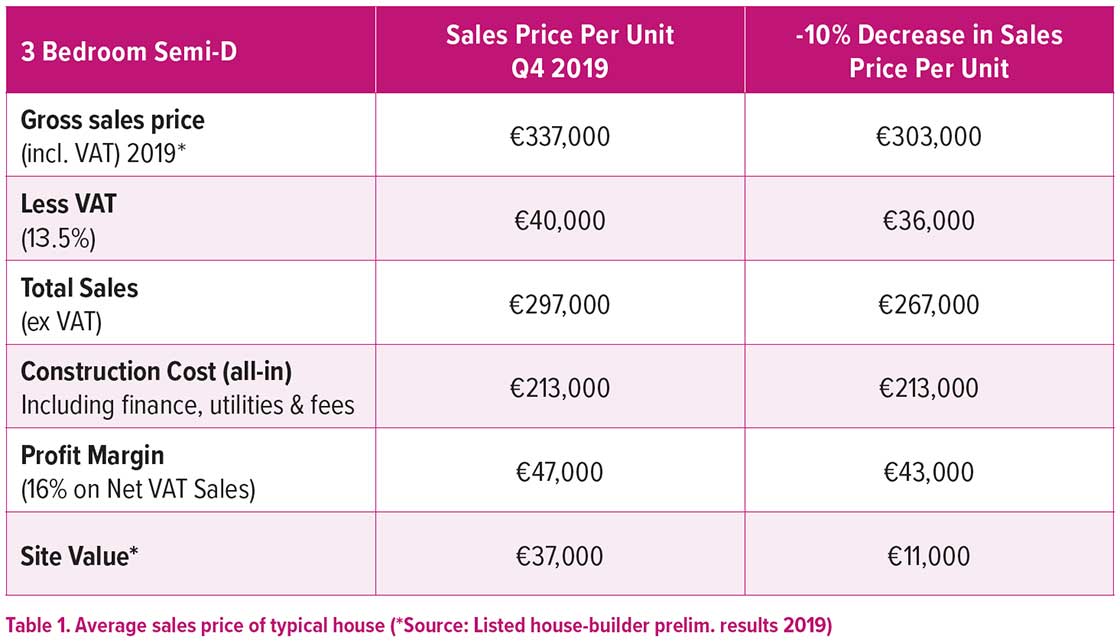

Table 1, above, is a hypothetical example to show how sensitive land values are to sales prices. In 2019, a typical new home in Dublin’s outer commuter belt priced at €337,000 had a site value of €37,000. This allowed for VAT on sales at 13.5%, total costs of €213,000 and a profit margin of 16% on net sales price.

The second column on the right shows what happens if new home sales prices fall by 10%.

A 10% drop in sales price in the above example leads to a 70% drop in site value.

Given that construction and development costs are almost static, a sales price drop is almost directly reflected in the ‘bottom line’ land value and the loss of value is amplified.

If the sales price in this case drops by more than 15%, then a negative land ‘residual’ value remains and this means that the project is no longer viable.

Implications

For developers who purchased sites recently, lower selling prices translate to lower margins and some projects may no longer be viable. Landowners selling sites may need to apply steep discounts depending on location etc. In a market where sales prices are falling, those intending to purchase development land may expect to get good value as corrections are factored into the market.

For landowners and listed housebuilders sitting on land banks with thousands of sites, small drops in sales prices may have a more significant effect on underlying land values than recent commentary would suggest.

No one will build at a loss (or get funding) and historically when markets fall, builders finish out current phases on-site and mothball developments until prices rise again.

A silver lining...

Most purchasers, provided they are still employed and can get a mortgage, will view a fall in house prices as a positive development – housing may become more affordable.

The industry has been complaining of elevated land values impacting on affordability for some time, so lower land values should be welcomed. Not good news for speculators, but for builders intending to purchase land to build, lower site prices may create the climate for more affordable prices.

Short term pain for long term gain. Yesterday’s problems of land speculation, high site values and severely unaffordable housing were a result of poor government policy and crude market dynamics. A key question had been how to reduce land values.

Falling prices today may give rise to tomorrow’s opportunity, a more affordable housing sector.